Retirement is Not a Dream

- Dave Loh

- Nov 19, 2018

- 3 min read

Updated: Nov 21, 2018

Retirement always seems like a faraway dream but time has a way of creeping up on you- before you know it, you’ll find yourself nearing your golden years and retirement won’t seem so far away anymore. I have been approached countless time to solve this ‘magic’ question. “Dave, when can I achieve my retirement milestone?”

Globally, with increasing advancement in healthcare and technology, we are likely to live longer than our pioneer generations. A recent finding shows that the average life expectancy age is 85 years old. With this, how do we ensure we do not outlive our savings?

In the Singapore context, we have the CPF lifelong income for the elderly (CPF Life) that provides us with a lifetime monthly annuity pay-out. The full retirement sum as at 2018 for those turning 55 is pegged at $171k, hence citizens will receive around $1,100 per month during their retirement. However, there are some citizens who have not reached this sum. Therefore, other than CPF Life we should familiarize ourselves with other alternatives to ensure our retirement falls into line.

I.e. Jack is a 35 year old IT analyst. His annual income is $60,000 and he is determined to retire the workforce for good at 55 years old.

Three steps to calculate your retirement needs:

Step 1: How much would you need?

Jack’s pre-retirement annual income is $60,000. His retirement income will make up about 70% of his current income. Therefore, he’ll need $42,000 during retirement.

Step 2: Lead time

Retirement Age (55) — Today’s Age(35) =20 years lead time for retirement.

Step 3: Retirement needs

-Method i. Accumulate the retirement needs that you required:

85 (average age) — 55(retire age) =30 years

$42,000 (Assume annual retirement income) x 30 years =$1,260,000.

-Method ii. Rely on your pension and generate interest

If you have a sum of pension, you can use this as capital to generate your retirement income. Assuming the expected returns is 7%, in order to generate the annual retirement expenses of $42,000, you will need to have a sum of $600K to achieve the target amount. The calculation will vary depending on the expected returns rate.

Otherwise, you can also combine the 2 methods above. Do note that the inflation rate is not taken into consideration here.

3 myths about retirement: CAT

What does CAT remind you of? That’s right! 9 lives. The average economic cycle is around 10 years. Using this analogy, we can depict there are 9 windows of opportunities in our lifetime. With every cycle, we are able to catch the golden part of the investment. As the saying said, “Crisis is the turning point.”

C-Capital

It does not matter whether we have big wealth or small wealth, as long as we stay invested- that is the essence.

Jack wanted to have a head start for his retirement funds where he had contributed $100 per month at 25 years old. Assuming interest rate is 7% per annum, when he reaches 55 years of age he would have accumulated $120,000. Indeed, “the early bird catches the worms.”

If one wants to have $2000 per month after retiring, a monthly investment of $400 at 30 years old would suffice. However, if one starts investing at 50 years old, it would be almost quadruple to invest $1570 per month!

A-Advice

With the vast amount of information in this age of technology, one without any financial experience would likely be overwhelmed by the limitless amount of choices in the market. Therefore, a preferred financial specialist licensed by the Monetary Authority of Singapore governing body equipped with a wealth of solutions would be your best bet!

T-Time

This day and age, with limited resources (I.e time & funds), can we afford to make an unwise decision? If one can learn by themselves and manage it well, by all means. More often than not, one would not be so blessed.

Case in point:

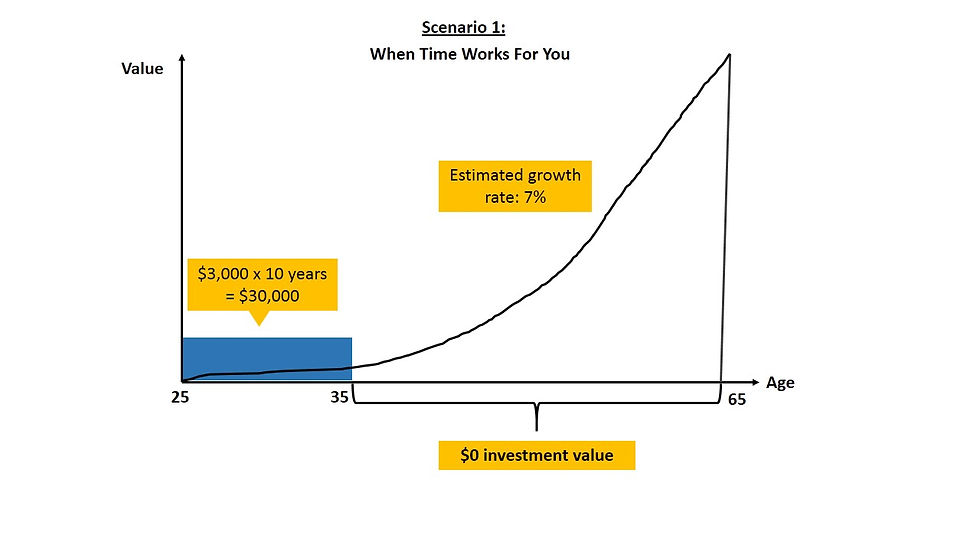

Scenario 1: Invest $3,000 per annum starting from age 25 and stay invested for 10 years, the investment input will reach $30,000, then you rely on the 7% compound interests to grow your wealth consistently.

Scenario 2: Invest $3,000 per annum starting from age 35 years old and stay invested for 30 years, the investment input will reach $90,000, you also rely on 7% compound interest to grow your wealth consistently.

Have you done your retirement planning? Click icon below to know more!

Guess what? The final results are very astonishing!

The total investment input for scenario 1 is $30,000 and the final income is $337,611. In situation 2, the total investment input is $90,000, and the final income is $303,219. The results in both scenarios were very close! Does it give you an idea of how to make our resources in our favor?

So my question to you would be: When will you start realizing your golden dream, TODAY or TOMORROW?

Comments